Let’s just get this straight. This is not a boring article. Running your own business is sexy. Accounting is sexy.

As a business owner, you’ll have a more challenging life. And, you’ll contribute more to the wider economy, as you will buy other goods and services for your company and you may even start to employ people – thus increasing demand and employment.

You can do it

Don’t believe me? OK, I’ll reveal how ridiculously stupid I used to be: I was bought up in the UK in the 1980s where most people, including Margaret Thatcher, assumed that in order for businesspeople to make money; other people needed to suffer. Yes, when I was young I really believed that! There’s actually a feeling in England, especially amongst the educated elite, that businesspeople, salespeople and entrepreneurs are somehow brash, pushy and dishonest.

Other than to piss off the English upper classes (and what could be better than that?), there are some solid financial reasons why you should start your own business. I’m reading Rich Dad Poor Dad at the moment and (although that’s an affiliate link, sorry!) I’m not finding it hugely useful. But here are two of the main arguments Robert T. Kiyosaki puts forward:

- You should always be improving your “financial intelligence” of which accounting is “financial literacy”. You should also keep trying to improve you knowledge of investments, markets and the law (government regulations and the like).

- The other thing that Kiyosaki explains is the basic tax difference between people and companies. Employees earn money, get taxed and then spend, whereas companies make money, spend everything they can and then pay tax on anything that’s left. So, working for yourself: good; working for someone else: bad. (Tell us something we don’t know, Robert!)

If you haven’t set up your own company yet I can hopefully further persuade you by saying that you can do this anytime – even if you are in full-time employment.

Naysayer interjects: It’s difficult to set up a company and even harder to organise! You end up with receipts everywhere and have a nightmare every year working on accounts!

I live in the UK and follow the local tax laws. Things may be different for you but I’ve got some really general accounting advice following that should be useful no matter where in the world you reside.

Setting up a company in the UK is fairly quick, fairly harmless and fairly cheap. After that all you have to do is to supply accounts every year.

Accounting

I have an accountant. He may charge me over $1000 a year (that’s an expense, see below) but, as they say, he’s worth it.

I spend about 3-4 hours doing the accounts for my business every year. Here’s how I collate all the information I give to the accountant and keep everything super simple:

- Have internet banking – I guess that’s a given these days?

- Make sure you make all the business expenses go out of this business account.

- Set up a business PayPal account that withdraws from this business account.

- If you can, get a credit card for the company.

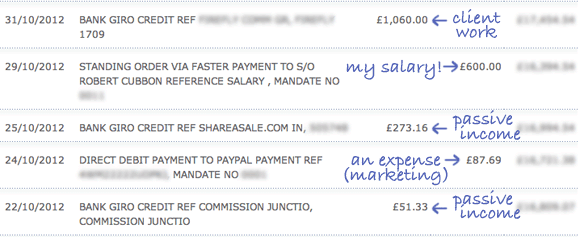

You can simply copy and paste from online banking into an Excel file and give it to your accountant. Bank accounts online are better itemised to it is easy to note to your accountant whether a withdrawal was for marketing, hosting, outsourcing, etc., and whether a deposit was for client work or passive income.

Outgoings

If you buy something for $100 then that’s $100 less profit that you’ll have to pay tax on. So I try to claim as much as I can. Here are the expenses I claim for.

- Tools of the trade: computers, laptops, tablets, smartphones, etc.

- Website expenses: hosting, domain name registration, stock images, email management, etc.

- General expenses: travel (to see clients), a proportion of telephone charges, use of house as office, broadband and anything that I use for my company (stationery, courses, books, etc.)

Incomings

My incomings can be roughly divided into two categories: invoiced client work and passive income.

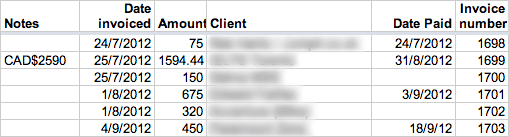

I keep account of the invoiced client work with the use of a spreadsheet on Google Drive throughout the year. It has the following columns:

- Invoice number. There’s a cool little Excel/spreadsheet trick of creating consecutive numbers without having to type them out.

- Date invoiced.

- Client.

- Amount.

- Date paid? Don’t get me started on late payers!

- Extra column for notes. This is useful for a description of the job and other issues like foreign currency conversions, etc.

Other financial considerations

Of course, it’s not so simple and it does involve hard work. Here are some other things to keep in mind while starting or running your own business:

- You could consider purchasing some insurance to cover you against injury or something like that.

- You should also start a personal pension

- If you’re from the US, you’ll need private medical insurance.

More importantly, when you’re running your own business, you should keep large surpluses both in your personal bank account and your business bank account to tide you over during the lean months. Indeed, before you start a business you should also have a few thousand in reserve.

This depends entirely on your own financial position and your ability to find work. I was really lucky as parttime freelance work was coming my way really easily when I started my business and I had that to fall back on during the lean times. If you’re giving up a well-paid permanent job you’ll obviously need more cushioning!

What you can do

Do you dread the time of year when you do the company’s accounts? See if you can automate the process by using your online bank statements as a record of your expenses. Ask your accountant who’s happy dealing with this sort of information on a spreadsheet.

Maybe you have other tips for accounting you can give us in the comments?

Looking forward to your sexy accounting input!

Nice article Rob. Interesting that you don’t rate the book, rich dad, poor dad. I was recommended this by my accountant (I haven’t purchased it yet) – so it sounds like this may not be for me. It’s always good to get some tips on the essentials of running your own business and some of the things you mentioned above, I will certainly need to do myself. Do you get your accountant to do your tax return or do you do that bit yourself?

Yes, I’d had Rich Dad Poor Dad recommended to me by several people and I’ve found it very disappointing.

I only get the accountant to do the company returns. I do the normal tax return.

What I didn’t mention in the article is that the accountant should advise you to pay yourself a mediocre wage (you can see this in the online banking screen shot above) and the rest in dividends of ideally around £5000. It takes a bit of getting used to! (This last bit is UK tax advice!)

Thanks Rob, I skim read Rich Dad Poor Dad some years ago. A good title but I thought his anecdotes were largely fictional to push his point. Still, I found some value in it.

Entrepreneurs accused of being brash and pushy! Does Lord Sugar know about this 😉

Surely, David, being half way round the world you’ll have forgotten the annoyances of British TV? 🙂

Your post is very clear and helpful. We use Quickens for our financial records. Have used it for years. Easy to do once you get everything set up on it. And it gives lots of interesting reports. In the US my hubby does our taxes using software from Turbo Tax. When we had our retail business, yes, we did need an accountant,. Thanks for the info.

Thank you JQ Rose, good to get some recommendations for accounting software to use. I’ve never gone down the software route but I’ve heard good things about Quickens and Freshbooks from a few people. Thanks for the US tax software recommendation as well.

It really helps other. Great job Rob!

Thank you, Sanjoy.

Very useful post 🙂

I am in the process of getting a business account for my company, as we have grown it is becoming harder and harder to have everything coming and going out of my current account and having Paypal set up to a savings account.

On the flip-side i do have everything recorded in my Google drive so i know where im at.

Hopefully a business account will help you, Scott. Then you have greater ability to separate out your business and domestic finances. Remember you can have a different PayPal account for each bank account – very useful! Yes, Google Drive is very useful. There’s Dropbox and a few others as well, I’m going to be writing about remote working shortly.

I never thought of creating a new Paypal account lol, i will be doing that straight away as my current one has a totally different email address than my companies one (doesn’t look very professional when giving details to clients).

i also use Dropbox for current project files, i like the fact that Drive has office tools already built in.

they are both good products, there are a few other options there as well.

im looking forward to reading your blog post about remote working

Yes, I’d definitely hook up a PalPay account to your business account. It makes things easier.

Lots of free cloud based services offering 2-5 GB but if you want 50-100GB backed up to the cloud, as in my case, you’re going to have to pay. 🙁

Great article. I have just started my own business and have been wondering if I should set up separate banking & pay pal accounts for it. I have only had my site up a short while but am already stressing about the financial aspects of running a small business.

Thank you so much for offering advice to us newbies. I find all of your articles extremely helpful.

Definitely have a different PayPal and business bank account, Claudia. My accountant is being really helpful I just download an Excel file from my bank account and my business PayPal account and he does the rest!

So glad you’re finding the blog helpful. Be sure to subscribe and get the e-books and not miss a thing! 🙂

Hi Rob,

I hate accounting! But it’s necessary.

However, I’m pretty good in keeping my receipts and so every single one of them are nicely organized.

I’m with you on this and I could not agree more when you said to keep a good saving when you are on feast because when it gets lean, it gets lean alright. And some of the clients don’t understand this.

“Why do you charge too much?” Well, first off, we work independent; and second of all, we don’t know when the next project is going to come in. Unless of course you are working as a regular contractor like having a 40-hours job a week. It’s different.

I guess I’m doing it right to begin with. I do have a checking just for business only and have a paypal for business only. Anyway…

Thanks for all the great info here.

Angela

Thank you, Angela, by the sound of it you are really starting off on the right foot. This will save you time later.